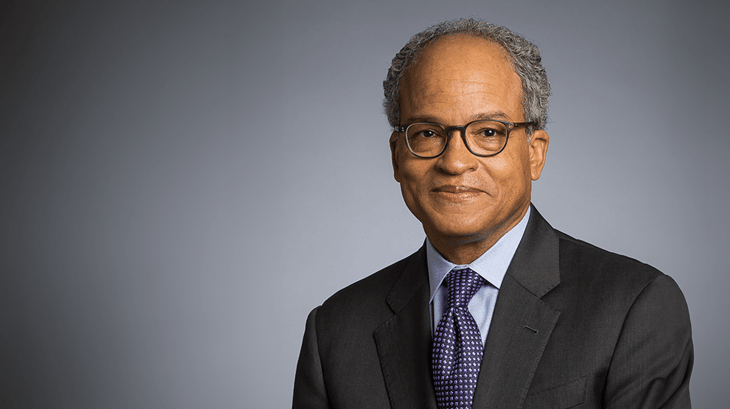

Despite agreeing with the objectives of proposed US Treasury rules on the Inflation Reduction Act’s (IRA’s) clean hydrogen production tax credit (PTC), Jason Few, CEO of FuelCell Energy, has told H2 View, they could be jumping the gun.

While supporting the proposed 45V PTC guidance, which included the three pillar requirements of additionality, geographical and hourly correlation for electrolytic hydrogen producers, Few said the rules “are perhaps jumping ahead to 20 years from now.”

To gain access to the 45V’s top tier $3/kg PTC, the proposed guidance would require US green hydrogen producers to source renewable electricity from the same regional grid, from assets that are no older than three years old at the time of hydrogen production start-up.

... to continue reading you must be subscribed